There was a certain scenario that we had to work with in this project. We had a college plan that was created 18 years ago by our guardian angel, with $18,000. Each month, $50 was added to the plan ($600 yearly). After 18 years at an average annual interest rate of 7%, compounded annually, the plan is now worth $49128.87. Yesterday, you cashed out your plan and deposited the money in a brokerage account to invest on your own.

In order to see if a stock is worth buying, I’ll look at the value. I want to see what’s low, and then sell it higher. I chose to have a longer time horizon because of my SMART goals. It’s going to take awhile before I can achieve them, but I’m totally up for it. I took a quiz online with the Rutgers New Jersey Agricultural Experiment Station, and I scored a 25, which means I have a average/moderate tolerance risk. Below, I have my goals listed for 1 year, 5 years, and 25 years.

1-year goal: Save about $15,000 to travel for one full summer.

5-year goal: Put a down payment of $10,000 for an Audi.

25 year goal- Buy a home in Lincoln Park: $350,000

I value companies that are family owned because there is a personal touch added to that company. It’s also easier to control that company and figure out the outcomes for that business. Another reason why I value them, is because those kind of companies value and understand the lifestyle of a larger family better, so they’ll do their best to meet their needs.

Company 1- Walmart.

I decided to invest in Walmart because other companies and retailers have tried to go head to head with Walmart, but have not been able to compete with their low prices. Their buying power has made their economic moat wide and sustainable. I also appreciate their mission which is, “Saving people money so they can live better”. It’s an international business, and it’s expected that Walmart will keep on making acquisitions internationally as time goes on to boost growth in the global market. They have a healthy payout ratio of 42.89%, which means that it has the potential to keep or increase its dividends.

Company 2- Walt Disney.

I decided to invest in Disney because it has an excellent growth rate. It gets that rate from its movie studio, business segment, consumer merchandise and theme parks. It’s also a top 10 stock. While doing my research, I discovered that it has a 10 year dividend growth rate of 23%. It also has a reasonable p/e ratio of 18.

Company 3-TJX.

The company TJX owns stores like TJ MAXX, Marshalls, and Homegoods. This company takes in name brand products that didn’t sell, and put them at a lower price in their department stores. Their highest earning revenue comes from their housing products because of the housing market recovery. It’s profit growth is expected to be 10%, while other department stores have only a single digit number when it comes to their growth.

1 year portfolio

I invested $15,000 in my one year goal.

30 shares of Wal-Mart at $70.11($2,103.30)(28% profile)

60 shares of TJX at $73.66($4,419.60)(72% profile) WMT and TJX together, has an expected ROI of 24.92%

50 shares of Disney at $93.71 ($4,685.50) (30%)

22 shares of Wal-Mart at $70.11 ($1,542.42)(70%) DIS and WMT together, has an expected ROI of 389.27%

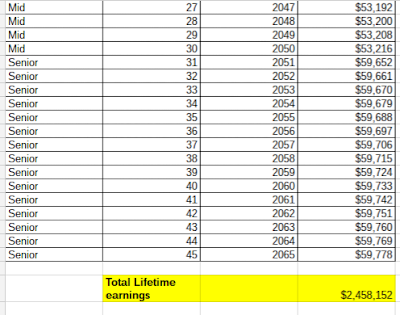

25 year portfolio

I invested $350,000 for my 25 year goal.

70 shares of TJX at $73.66($5,156.20) (60%)

50 shares of Disney at $93.71($4,685.50) (40%) TJX and DS together, has an expected ROI of 11681%.

I made three different investments, and 2 of them are in the same stock sector. Wal-mart and TJX is listed under consumer goods, and Disney is put under Entertainment. While deciding, I wanted to have at least one different stock in a different sector, which is one of the reasons why I chose Disney. Based on the math I did, I'm going to be able to reach my goals.

22 shares of Wal-Mart at $70.11 ($1,542.42)(70%) DIS and WMT together, has an expected ROI of 389.27%

25 year portfolio

I invested $350,000 for my 25 year goal.

50 shares of Disney at $93.71($4,685.50) (40%) TJX and DS together, has an expected ROI of 11681%.

Citations:

Weil, Dan. "Best Investments: Good Investments In 2016 And Beyond | Bankrate.com." Best Investments: Good Investments In 2016 And Beyond | Bankrate.com. N.p., n.d. Web. 30 Oct. 2016.BasuMallick, Chiradeep. "5 Reasons Why Disney Is a Must-Have Stock."TheStreet. N.p., 02 Sept. 2016. Web. 30 Oct. 2016.

Rossolillo, Nicholas. "Is Wal-Mart a Good Dividend Investment?" The Motley Fool. N.p., 01 Jan. 1970. Web. 30 Oct. 2016.